Trick Steps to Effectively Developing an Offshore Company for Global Operations

Establishing an offshore firm for global procedures can be a strategic step for services seeking to increase their reach and enhance their procedures. The subtleties and complexities associated with this procedure need careful preparation and implementation to ensure success. From choosing the appropriate jurisdiction to browsing legal and tax ramifications, each action plays a crucial role in laying a solid structure for global company ventures. There is one vital element that typically goes overlooked however is essential for lasting sustainability and growth.

Picking the Right Jurisdiction

Selecting the proper jurisdiction is an essential decision when establishing an overseas firm for international operations. The territory you choose can have significant implications on the success and efficiency of your business ventures. One essential variable to consider is the legal framework of the territory. Various nations use differing levels of regulatory convenience, tax incentives, and investor protection. It is crucial to perform detailed research to make sure that the picked territory lines up with your business objectives and gives a secure legal environment.

Moreover, the online reputation of the territory also plays a crucial role. Selecting a jurisdiction with a strong track record for monetary stability and openness can enhance your company's reliability and bring in prospective clients and capitalists. Additionally, taking into consideration the financial and political security of the territory is vital to mitigate risks and uncertainties that could influence your operations.

Comprehending Lawful and Tax Ramifications

When developing an overseas firm for worldwide procedures, a comprehensive understanding of the legal and tax obligation implications is necessary for informed decision-making and conformity. Lawful factors to consider involve adhering to the legislations and guidelines of the jurisdiction in which the overseas business is signed up. This includes understanding corporate governance requirements, reporting obligations, and any kind of constraints on service activities. Failure to abide by these legal needs can lead to charges, fines, and even the dissolution of the business.

Engaging lawful and tax experts with competence in offshore business development can give important understandings and support to browse the complicated lawful and tax obligation landscape, inevitably facilitating a smoother establishment process and continuous compliance.

Picking the Perfect Corporate Structure

The selection of a suitable company structure is essential in the strategic planning of an overseas company for international operations. When establishing an overseas entity, picking the perfect business structure calls for cautious consideration of various factors such as the nature of business, the jurisdiction's legal needs, tax obligation effects, and the business's long-term objectives. Typical company frameworks for overseas firms consist of Restricted Obligation Firms (LLCs), International Company Companies (IBCs), and offshore branches of existing firms.

LLCs are commonly chosen for their versatility and limited responsibility security, making them appropriate for a wide variety of companies. IBCs, on the other hand, are commonly utilized for global trade and financial investments due to their tax obligation advantages and simplified coverage requirements. Offshore branches are expansions of existing business and can profit from the parent company's reputation and resources while running in a various jurisdiction.

Inevitably, the ideal corporate structure for an overseas firm will depend on the specific requirements and objectives of business, as well as the regulatory environment of the selected jurisdiction. It is advisable to look for professional assistance to guarantee compliance with all economic and legal policies.

Opening Offshore Financial Institution Accounts

Establishing a perfect company structure for an offshore company lays the structure for browsing the complexities of worldwide operations, a Homepage vital action that leads the way for the next critical factor to consider: Opening Offshore Financial Institution Accounts. When it involves offshore banking, selecting the best jurisdiction is paramount. Various countries offer differing levels of financial security, governing frameworks, and tax motivations. Performing detailed research study or looking for expert recommendations can help in making an educated decision.

As soon as the jurisdiction is chosen, the procedure of opening up an offshore bank account starts. Demands might include supplying in-depth company details, evidence of identity for advantageous owners, and showing the genuine resource of funds. Maintaining openness in economic transactions and sticking to anti-money laundering policies are essential for the long life and success of the overseas business.

Conforming With Regulatory Needs

For a successful overseas firm, adherence to governing needs is important to make sure legal conformity and functional stability. When developing an offshore firm for international operations, it is crucial to comprehend and you could check here abide with the regulative structure of the jurisdiction in which the company will certainly be based. offshore company formation. This consists of sticking to business registration treatments, tax obligation legislations, reporting needs, and any type of specific policies governing overseas entities

To ensure compliance, it is a good idea to involve lawyers with experience in overseas policies. These experts can supply advice on structuring the business in a compliant fashion, obtaining necessary licenses and licenses, and maintaining recurring compliance with regulatory obligations.

In addition, staying notified regarding any modifications in regulatory requirements is important for the long-lasting success of the offshore firm. On a regular basis upgrading and assessing compliance treatments can help mitigate risks and make sure that the company operates within the bounds of the legislation.

Final Thought

To conclude, developing an overseas business for global procedures needs cautious factor to consider of territory, lawful and tax obligation ramifications, business structure, savings account, and governing requirements. By browsing these vital steps properly, services can gain from global opportunities while ensuring compliance with regulations and policies (offshore company formation). Successful establishment of an overseas company can supply countless benefits for international growth and development

Common company frameworks for offshore companies include Restricted Responsibility Business (LLCs), International Business Companies (IBCs), and offshore branches of existing firms.

Offshore branches are expansions of existing firms and can benefit from the parent firm's reputation and sources while running in a different jurisdiction.

Developing an optimal company framework for an offshore firm lays the structure for Visit Your URL navigating the intricacies of international operations, an important step that leads the method for the next critical consideration: Opening Offshore Financial Institution Accounts - offshore company formation. When establishing an offshore firm for international operations, it is essential to conform and comprehend with the governing framework of the territory in which the business will be based.In conclusion, developing an overseas business for global operations requires careful consideration of jurisdiction, legal and tax implications, business framework, financial institution accounts, and regulatory requirements

Alicia Silverstone Then & Now!

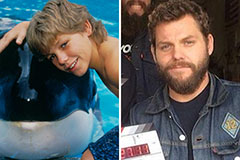

Alicia Silverstone Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!